Some Ideas on Frost Pllc You Should Know

Table of ContentsFrost Pllc for DummiesA Biased View of Frost Pllc7 Simple Techniques For Frost PllcSome Known Facts About Frost Pllc.Unknown Facts About Frost Pllc

Certified public accountants are among one of the most trusted careers, and permanently factor. Not only do CPAs bring an unequaled degree of understanding, experience and education and learning to the procedure of tax planning and handling your money, they are especially educated to be independent and unbiased in their job. A CPA will certainly aid you protect your passions, pay attention to and address your worries and, equally important, provide you satisfaction.Hiring a local Certified public accountant firm can positively impact your company's financial wellness and success. A neighborhood Certified public accountant firm can aid lower your organization's tax obligation burden while making sure conformity with all appropriate tax legislations.

This growth shows our commitment to making a favorable impact in the lives of our customers. Our commitment to quality has been identified with several accolades, consisting of being called one of the 3 Best Accountancy Companies in Salt Lake City, UT, and Ideal in Northern Utah 2024. When you collaborate with CMP, you end up being component of our household.

The 30-Second Trick For Frost Pllc

Jenifer Ogzewalla I have actually functioned with CMP for a number of years currently, and I have actually truly valued their know-how and performance. When auditing, they function around my schedule, and do all they can to preserve continuity of employees on our audit.

Here are some key questions to guide your decision: Examine if the certified public accountant holds an active certificate. This guarantees that they have actually passed the needed exams and fulfill high moral and specialist criteria, and it shows that they have the credentials to manage your financial issues responsibly. Confirm if the certified public accountant offers services that line up with your business needs.

Little services have unique financial needs, and a CPA with relevant experience can provide more customized guidance. Ask concerning their experience in your market or with services of your size to ensure they recognize your specific challenges.

Hiring a local Certified public accountant company is more than just contracting out monetary tasksit's a wise financial investment in your company's future. Certified public accountants are licensed, accounting experts. Certified public accountants might work for themselves or as part of a company, depending on the setup.

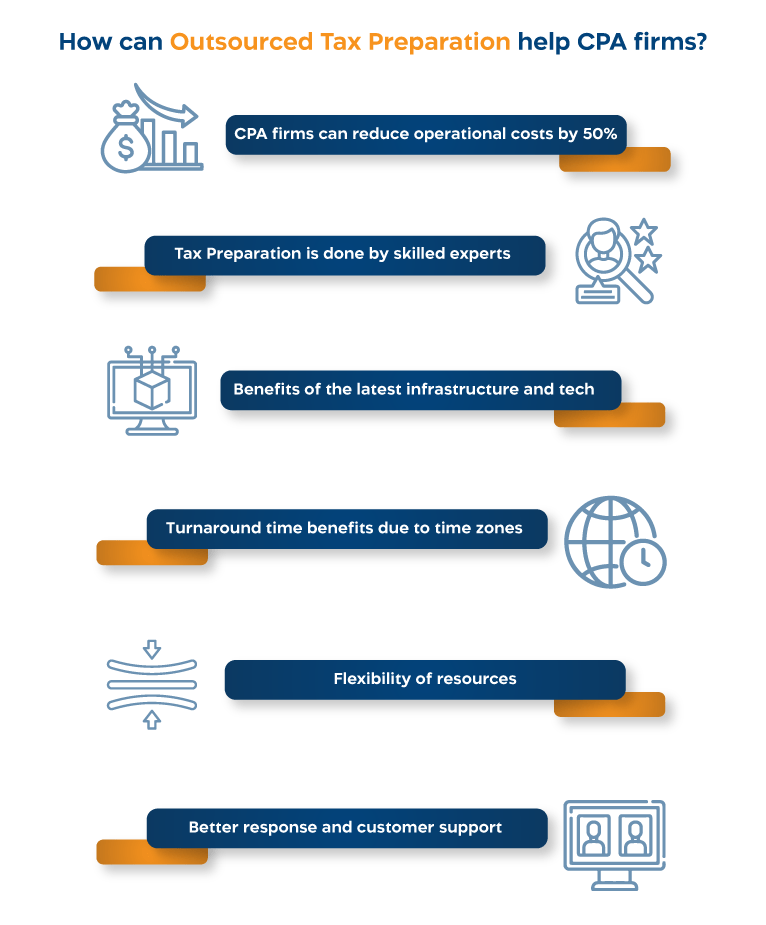

documents to a firm that concentrates on this area, you not just cost-free yourself from this time-consuming job, however you also free on your own from the danger of making errors that might cost you monetarily. You may not be making use of all the tax obligation cost savings and tax obligation deductions available to you. One of the most important inquiry to ask is:'When you conserve, are you placing it where it can expand? '. Many organizations have actually executed cost-cutting measures to minimize their overall expense, yet they have not put the cash where it can aid the business expand. With the assistance of a certified public accountant company, you can make one of the most educated choices and profit-making techniques, thinking about one of the most current, updated tax obligation rules. Federal government agencies in all levels call for paperwork and conformity.

The Only Guide to Frost Pllc

Taking on this obligation can be an overwhelming task, and doing something incorrect can cost you both financially find more info and reputationally (Frost PLLC). Full-service CPA firms are acquainted with declaring demands to ensure your organization follow government and state legislations, as well as those of banks, capitalists, and others. You might need to report additional income, which may need you to file an income tax return for the very first time

team you can trust. Call us for additional information concerning our services. Do you recognize the accountancy cycle and the steps associated with making certain proper financial oversight of your organization's financial health? What is your organization 's legal framework? Sole proprietorships, C-corps, S corporations and partnerships are strained differently. The even more complicated your revenue sources, places(interstate or global versus regional )and sector, the extra you'll require a CERTIFIED PUBLIC ACCOUNTANT. CPAs have much more education and undertake an extensive qualification process, so they set you back more than a tax preparer or accountant. Typically, tiny companies pay between$1,000 and $1,500 to work with a CERTIFIED PUBLIC ACCOUNTANT. When margins are tight, this expense might beunreachable. The months gross day, April 15, are the busiest season for CPAs, complied with by the months prior to completion of the year. You may need to wait to obtain your concerns answered, and your tax return could take longer to finish. There is a restricted variety of Certified public accountants to go about, so you might have a difficult time discovering one especially if you have actually waited until the last minute.

CPAs are the" big weapons "of the accountancy sector anonymous and typically don't manage everyday accountancy jobs. You can make certain all your funds are existing which you're in good standing with the IRS. Employing an audit firm is an evident choice for complicated businesses that can manage a qualified tax obligation expert and an outstanding alternative for any type of local business that desires to lower the possibilities of being examined and unload the worry and frustrations of tax obligation filing. Open rowThe distinction between a CPA and an accounting professional is merely a legal distinction - Frost PLLC. A CPA is an accounting professional certified in their state of operation. Just a CPA can supply attestation services, function as a fiduciary to you and function as a tax attorney if you deal with an IRS audit. Regardless of your scenario, also the busiest accountants can relieve the moment worry of submitting your taxes on your own. Jennifer Dublino contributed to this write-up. Resource interviews were performed for a previous variation of this article. Accountancy companies might additionally employ CPAs, yet they have other types of accounting professionals on staff. Frequently, these various other types of accounting professionals have specialties across areas where having a CPA license isn't needed, such as administration audit, nonprofit accounting, price accounting, government accountancy, or audit. That does not make them less qualified, it simply makes them differently qualified. In exchange for these stricter policies, Certified public accountants have the lawful authority to authorize audited monetary declarations for the functions of coming close to financiers and safeguarding funding. While bookkeeping business are not bound by these very same laws, they have to still comply with GAAP(Usually Accepted Audit Concepts )ideal techniques and exhibit high

honest requirements. Because of this, cost-conscious little and mid-sized business will frequently use an accountancy solutions company to not just meet their accounting and accounting demands now, but to scale with them as they expand. Don't let the perceived eminence of a company loaded with CPAs distract you. There is a misunderstanding that a CPA company will certainly do a much better task since they are lawfully enabled to

carry out more activities than a bookkeeping business. And when this holds true, it doesn't make any kind of feeling to pay the costs that a CPA firm will certainly bill. In most instances, companies can save on costs considerably while still having actually premium work done by making use of a bookkeeping solutions business rather. Because of this, using an audit services company is often a much much better value than employing a CPA

What Does Frost Pllc Do?

company to sustain your continuous economic monitoring initiatives. If you just need acting accounting help while you deal with working with a full time accountant, we can assist with that also! Our bookkeeping and money recruiters can assist you bring in the best prospect for an internal role. Contact us to discover more today!. They can collaborate to make certain that all aspects of your financial plan are aligned which your financial investments and tax obligation methods interact. This can result in much better outcomes and more effective use your resources.: Collaborating with a combined CPA and economic advisor can conserve prices. By having both professionals functioning together, you can prevent replication of solutions and potentially reduce your general costs.

CPAs also have competence in establishing and perfecting organizational plans and treatments and assessment of the functional demands of staffing models. A well-connected CPA can utilize their network to assist the organization in different tactical and consulting functions, efficiently linking the Bonuses company to the suitable prospect to meet their demands. Following time you're looking to load a board seat, consider reaching out to a CPA that can bring value to your organization in all the ways noted above.